The Inflation Reduction Act is the largest clean energy investment America has ever made, and includes upfront discounts and tax credits that provide money for every household to electrify the machines you rely on to drive, heat the air and water in your home, cook your food, dry your clothes and get your energy — regardless of your income level.

The IRA provides you with a personal fund of up to $14,000 per household per year. The up-front discounts (income-dependent, available in early 2024) and tax credits (available now) cover a portion of the cost to swap out your old appliances for new, clean, efficient electric ones. They can also help with the cost to rewire your house and upgrade your electric meter, if needed.

So how do you harness these incentives to save money? Here are our top 3 tips:

- Check out the IRA Calculator from Rewiring America to see what incentives are available to you. Knowledge is power! Put a few details into this online tool and get a helpful, personalized overview of how the IRA can help you with the upgrades you’re hoping to make to your home.

- Plan your upgrades to fit into the yearly tax credit limits. Efficiency upgrades are divided into three groups, each with a separate annual allowable limit for how much you can claim. You can use the maximum tax credit for each group every year, so it’s worth it to plan your projects accordingly so you can claim as much as possible.For example, there is a maximum yearly credit of $1,200 for the group including energy audits, electric panel, doors, windows, and insulation. There is a separate maximum yearly credit of $2,000 for the group including heat pumps and heat pump water heaters. In year one, you might upgrade your electrical panel and install a heat pump, and then in year two upgrade your insulation and windows and put in a heat pump water heater, putting yourself in a better position to claim the max in both groups for each year. For more info, check out this great Electrify Now Fact Sheet

- Work with a trusted contractor who is knowledgeable about incentives. You don’t have to navigate this on your own! A quality contractor will be able to help you make a plan for how to approach your project and make the most of available incentives. They’ll also work with you to ensure that the equipment you install meets the efficiency criteria to qualify for the incentives.

Tell me more about this IRA I’ve been hearing about

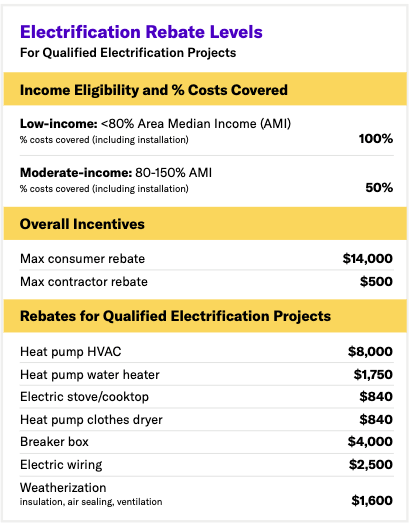

The IRA funnels a majority of the money to low- and moderate-income households who can least afford to upgrade to efficient electric, but will benefit the most from the lower utility bills and greater comfort. That’s why the incentives are divided into two main categories:

Up-front discounts

Coming in early 2024. Officially called High-Efficiency Electrification Rebates (HEEHR), these up-front discounts will happen right at the point of purchase—covering up to 100% of project costs for low-income households and up to 50% for moderate-income households. If your household is over 150% of your Area Median Income (AMI) you won’t qualify for these up-front discounts. Another thing to note: these rebates only apply if you’re replacing a non-electric appliance (e.g. gas furnace) with an efficient electric one (e.g. heat pump).

Because the HEEHR rebates will be implemented at the state level, they’re not expected to be available until early next year. We’re following this closely, and will be talking more about this in upcoming newsletters as more information becomes available. Here is a great info sheet about the up-front discounts from Rewiring America

Tax credits

The IRA tax credits are available right now, regardless of income, and will reduce your final costs by up to 30%. You’ll pay full price up-front, but the government will pay you back for some of it when you file your taxes.

These tax credits help offset the cost of installing heat pumps, heat pump water heaters, insulation, doors, windows, electrical panels, and more. There are also tax credits available for rooftop solar, battery storage, used and new electric vehicles, and EV chargers.

Some fine print:

- The home must be located in the U.S. and be used as the taxpayer’s primary residence.

- To ensure you can qualify for tax credits for installation of heat pumps and other items, the equipment must meet certain efficiency criteria.

- There are maximum yearly credits available, and a yearly tax credit limit.

- Tax credits are one-time transferable. So if you don’t have the tax liability to use them yourself, you can find someone else to ‘buy’ them from you.

Download Electrify Now’s helpful Tax Incentive fact sheet for more information

Check out the IRA Calculator from Rewiring America to see what incentives are available to you!

Energy Trust Incentives

You may also qualify for Energy Trust Incentives. And yes, you can double-up and get both IRA and Energy Trust incentives! There are incentives for insulation, thermostats, water heaters, heat pumps, washers and dryers, solar, windows, and more. For each one, you click on the ‘Search Incentives’ tab, fill in your local utility provider, and learn what’s currently being offered. For example, Energy Trust offers incentives ranging from $500 to $1,350 for heat pumps, depending on type and what’s being replaced (larger incentive if you’re replacing an older electric furnace) Use this quick form to see what heating/cooling incentives your home qualifies for. Energy Trust trade ally contractors can also help figure this out for you.

What if I rent?

Renters can also take advantage of the IRA’s up-front discounts and tax credits. Upgrades such as portable heat pumps, induction cooktops, and heat pump clothes dryers can be used in a rental and taken when you move. Renters also qualify for the used and new EV tax credits.

The Energy Trust of Oregon doesn’t offer incentives directly to renters, but they do have incentives for landlords for energy efficiency upgrades to rental properties, including heat pumps, smart thermostats, and better insulation. Get more details here.

For additional information on what renters can do—including a sample letter you can send your landlord with things they can do—check out our blog post we shared earlier this year.